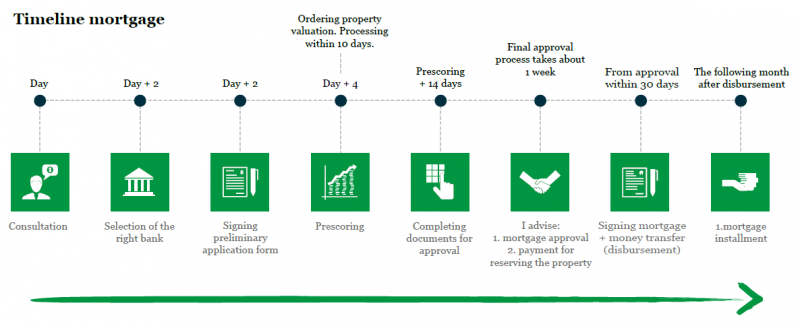

Mortgage Timeline

The mortgage administration process includes several steps taking up to 5 or 6 weeks. Let's have a look at it in brief.

1) Consultation

Mortgage adviser compares several banking institutions and their interest rates, fees or monthly instalments. It makes you know the maximum amount of money banks can lend you.

2) Selection of the right bank

The choice of a bank should be made not only with regard to the lowest rate but on the grounds of the total costs.

3) Signing preliminary application form

After finding out the most favourable product you should submit a preliminary application form.

4) Prescoring

Before the final selection of the property, you should get acquainted with concrete conditions under which the bank is willing to give you a mortgage. That is the sense of prescoring which is carried out by the bank.

5) Completing documents for approval

Documents necessary for mortgage approval include primarily an income statement, account statement, evaluation of the property and a draft of both reservation and purchase contract.

6) Final approval

At this moment you can be sure your funding is secured.

7) Signing mortgage & disbursement

This step usually follows within 2 or 4 weeks since the approval.

8) Mortgage instalment

You usually start paying instalments the month after disbursement.